SMEs in Europe

Biopharmaceutical SMEs and their role in the industry

Biopharmaceutical small and medium-sized enterprises (SMEs)* are key drivers of innovation in Europe. They play a major role in the development of new medicines, particularly in sectors that are under-served due to technological challenges or lower expected market potential, such as biological approaches, potential pandemics, infectious and rare diseases. For example, from all medicines from SMEs that were recommended for marketing authorisation between 2005-2015, 1 in 2 contained a new active substance and 42% of the medicines were for rare diseases[1]. Additionally, 81% of preclinical projects in the antibacterial pipeline are in SMEs. This huge added value that SMEs bring to the industry underlines the importance of their role and the need to create an ecosystem that supports this innovation[2].

The SME ecosystem

SME funding sources

SMEs with bright ideas and a strong team have a range of options when looking for early-stage investment. Grants, seed venture capital and loans support companies in their early stages of development. The challenges mount if the preclinical phase goes well. Early success brings a significant increase in the need for funding.

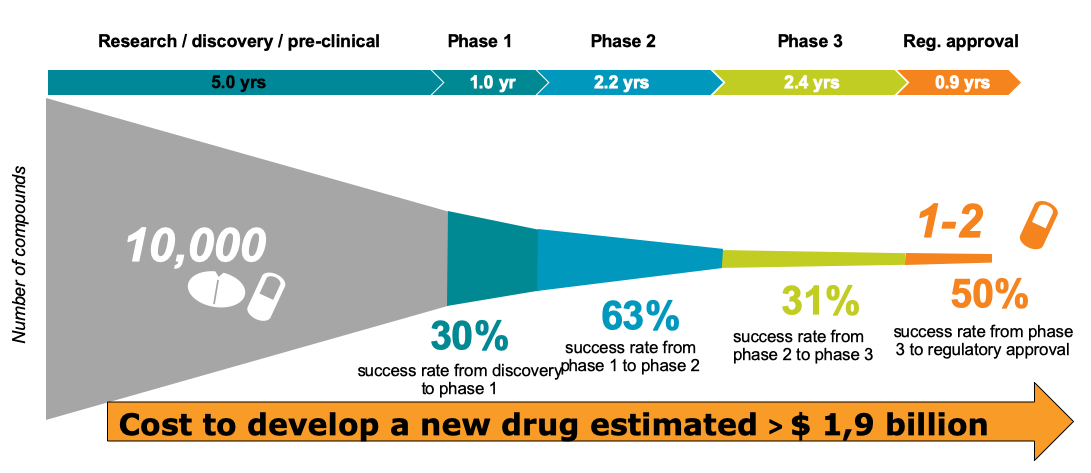

The reason is simple: clinical trials are very costly and time-consuming, at a different level than start-ups and fast-growing small IT firms or green-tech companies.

Source: DiMasi et al, Journal of Health Economics, January 2016

Companies typically look to venture capital or private equity support for this high-risk/high-reward investment. Other solutions – such as public listing, joint ventures and partnerships with larger pharmaceutical companies – are also an option. For European biopharmaceutical SMEs, the final phases of product development usually necessitate either making a deal with an established multinational firm or relocating to the US. Ultimately, few European SMEs bring their products to market alone.

The gap between the early stages of product development, currently well supported, and reaching the market is often called the ‘valley of death’ – a chasm into which countless innovative firms are lost.

EFPIA SMEs’ proposal for an innovative funding in Europe

To mitigate this gap, EFPIA SMEs are currently discussing a proposal addressed to the European Commission to develop financial instruments that would create new ways of risk-sharing and boost the size of venture capital funding. There is a need to create large specialised European life science guarantee funds composed of public and private investors such as the European Investment Bank, pension funds, insurance companies and banks. These investors could invest in all phases of the SME development from early stage to market launch. Such an innovative funding mechanism would help retain European innovative SMEs that go to the US to finance their development.

A robust EU industrial and pharmaceutical strategy is important for SMEs

Additionally, a robust EU industrial and pharmaceutical strategy must be at the heart of the European landscape that emerges from the pandemic. To make Europe an innovation hub, companies and investors need to see a stable regulatory system, a supportive intellectual property regime, access to market, and a strong research ecosystem.

Urgent policy reforms needed to support the future of Europe’s biopharma SMEs

Read the Analysis from the SME landscape in Europe, by Charles River Associates for EFPIA.

The report concurs with President von der Leyen’s commitment in her political guidelines in July to boost the EU life science sector during the next mandate, and is also supported by the Draghi’s report on the future of European competitiveness published early September.

Why is intellectual property important for SMEs?

EFPIA SMEs position on the EC SME Strategy

-

Europe’s COVID-19 response points the way to fighting AMR

Antimicrobial resistance: Perspectives from a pharmaceutical SME16.07.20Read Article -

How biotech SMEs adapted to COVID-19: An interview with Minoryx Therapeutics

As the pandemic threatened to disrupt key clinical trials, a small company responded swiftly to protect patients and keep rare diseases research on track16.07.20Read Article

*Biopharmaceutical SMEs are enterprises focussed on the discovery and development of biopharmaceutical products for human healthcare, based on tools and approaches from modern biotechnology. They have a turnover of less than €50 million, and up to 250 employees. To find out more about the EFPIA SME members, click here.

Additional Resources

- EMA report on the 10th anniversary of the SME initiative

- McKinsey 2019 report on Biotech in Europe: A strong foundation for growth and innovation

- EFPIA study on the access to finance and barriers to growth in the innovative biopharmaceuticals sector

- European Investment Bank study on Financing the next wave of medical breakthroughs – What works and what needs fixing?

- EC annual report on European SMEs

- EC SME Strategy

[1] EMA, REPORT ON THE 10TH ANNIVERSARY OF THE SME INITIATIVE, 2016

[2] THEURETZBACHER, U. ET AL. NAT REV MICROBIOL (2020)