EU strategic resilience in pharmaceuticals: global value chains and innovation

Today the core of the world’s efforts, including those of the research-based pharmaceutical industry, are focused on finding treatments, diagnostics and vaccines to combat the COVID-19 pandemic. The crisis has brought Europe’s resilience to global health threats into sharp focus. One concept that has been much discussed recently as a result has been the need for the region to have an ‘open strategic autonomy’. The terminology is worth exploring in more detail as ‘open’ and ‘autonomy’ appear to be an oxymoron and more autonomy in a global world presents some very real risks for Europe. The EU may well be at a policy crossroads: giving up its comparative advantage in cutting edge, high value health interventions to instead produce lower value products possibly at a higher price than currently available. Could this be the direction anyone would want for Europe? Wouldn’t more “strategic resilience” be what we should actually aim to achieve?

On April 17, the European Parliament stated its support for the Commission “in its objective of designing a new EU industrial strategy in an effort to achieve a more competitive and resilient industry when contending with global shocks; supports the reintegration of supply chains inside the EU and increasing EU production of key products such as medicines, pharmaceutical ingredients, medical devices, equipment and materials”. The roadmap leading to the Pharmaceutical Strategy also states that “The EU's growing dependency on imports of medicines and active pharmaceutical ingredients (APIs) due to manufacturing outside the EU may result in shortages in case it is not counterbalanced by a sufficient level of diversification of EU supply chains. This may raise health security risks and is a concern for the EU’s strategic autonomy, under normal circumstances but also under a crisis situation.”

These statements focus on manufacturing autonomy. While this may sound like an appealing quick fix to issues highlighted in the COVID-19 crisis, it is likely to actually be very detrimental for many industries and for the region as a whole.

Why?

First, the idea of ‘autonomy’ fails to recognise that there are very clear reasons why some manufacturing does not take place in the EU. The lower cost base, more global resilience, specialisation, economies of scale and the comparative advantage the EU has in producing other higher value-added goods and services, are all reasons why some products are manufactured elsewhere. Is Europe willing to accept significant price increases for basic generic medicines? Will Europe give up comparative advantages in more cutting edge, high value-added areas?

Secondly, a short-sighted focus on manufacturing would fail to acknowledge that manufacturing starts with Research and Development (R&D)[1] and that it is the R&D elements of the supply chain where the most value is generated for an economy.

To find the right policy path for Europe means understanding the data and issues that will impact Europe’s research, resilience and recovery. To support that process, we set out a number of observations which we hope can contribute to a shared understanding of the evidence.

Observation 1: The EU’s innovative pharmaceutical industry is resilient today and not dependent on third countries like China or India:

- Fact 1: The EU is the largest exporter of medicines in the world, with a global market share of 63.8% (Euro 383 billion).[2] [3] One of the main reasons for the EU being such a large exporter is the historically strong R&D position of Europe. R&D leads to innovation and innovation leads to first-mover advantages in advanced production.[4]

- Fact 2: According to an EFPIA-survey conducted in February 2020, 77% of all APIs needed for innovative medicines production in the EU come from the EU itself; 12% of APIs come from the United States and only 9% from Asia (including Japan and South Korea). In other words: Europe is not strategically dependent on China and India.

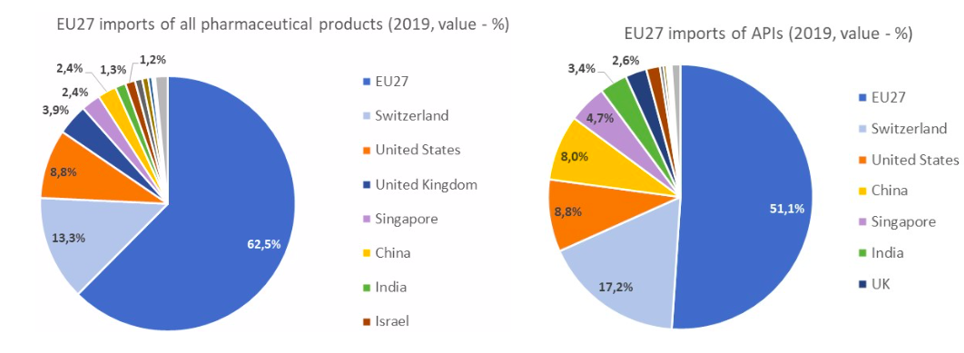

- Fact 3: An ECIPE (2020) data publication[5] shows that 77% of EU imports for all pharmaceutical products come from Europe itself (the EU, Switzerland and UK), followed by 8.8% of from the US. Only 2.4% and 1.3% of EU imports of pharmaceutical products come from China and India, respectively. Regarding active pharmaceutical ingredients (APIs), the roles for China and India are larger (8.0% of EU imports come from China and 3.4% from India) but still far behind the shares coming from the EU itself (51.1%), Switzerland (17.2%) and the US (8.8%).

Observation 2: EU industries need strategic openness and innovation

If repatriating supply chains and turning inward will weaken the EU significantly, what should the EU do to increase its strategic resilience? The EU should play to its strengths: a tradition of R&D and innovation and international trade.

- A tradition of R&D and innovation

The EU has a long-standing tradition in R&D and innovation. Thanks to the existing innovation framework, today many companies in Europe can speed up research into diagnostics, treatments and vaccines to beat the COVID-19 pandemic for example. Also, thanks to that innovation framework, the EU is the dominant global exporter of medicines. As mentioned earlier, the EU is the largest exporter of medicines in the world, with a global market share of 63.8% (Euro 383 billion).[6]

“Innovation does not have a button that you can switch on and off when you want” said Nathalie Moll, EFPIA Director-General. Resilience against a future pandemic lies in the way Europe will be able to strengthen its innovation framework and enhance its innovative capabilities and infrastructures. R&D will provide the EU with the best opportunity to reduce shortages and support advanced and science-based manufacturing. In the 1990s, the EU was the primary destination for investments in innovative pharmaceuticals. This position has since gone to the US and currently China is in the process of overtaking the EU as well. If the EU fails to act, the bloc will continue to give way to the US and China. They will take over the EU’s leading export position for medicines and introduce new treatments and vaccines in those regions first. Already today, more clinical trials for the innovative CAR-T cell therapy[7] are conducted in China (50.6%) than in the US (30.2%) or the EU (6.2%).[8] These examples should seriously concern the EU and encourage the bloc to take a consistent and long-term innovation-focused approach to reverse it. We need to carefully consider what we collectively want the EU to lead on in the future.

- International trade

The EU is the strongest trade bloc in the world, with a very large internal market and many deep bilateral trade relationships, supported by an extensive bilateral Free Trade Agreement (FTA) network. Exactly 90 years ago, the Smoot-Hawley tariff act was adopted in the US, aimed at supporting domestic jobs. This lead to retaliation from other countries and deepened the Great Depression.[9] The EU should not be turning inwards but focus on openness and on strong global supply chains.[10] It should strengthen and expand its strategic partnerships with the US and China, conclude ambitious FTAs with Australia and others, finalise the investment agreement with China, strengthen its trade defence instruments and FTA implementation and enforcement, and work on World Trade Organisation (WTO) reform to allow for rules-based trade in support of EU industries. The EU has initiated the ‘Health in Trade Products’ initiative at the WTO. This initiative focuses on facilitation of trade in healthcare products with a group of like-minded partners, and on avoiding trade disruptions in times of crisis.[11] We think this is an important step in the right direction in support of more strategic resilience. A comprehensive EU-UK trade agreement that includes a Mutual Recognition Agreement (MRA) on Good Manufacturing Practices (GMP) inspections, including batch testing, is also important. The MRA also matters because the larger the EU-UK disintegration, the more the US, China, Japan and others benefit, reducing the EU’s strategic resilience globally.

Concluding remarks

The personal and economic cost of the pandemic in Europe has been devastating. Now, more than ever it is critical that we use our strengths in international trade and innovation to help the region recover and become more resilient: via open trade and a strong focus on R&D and innovation. The innovative pharmaceutical industry's limited international dependencies in APIs and strong export position are mainly due to its strong research presence in Europe. We are therefore encouraged by the joint statement by President Macron and Chancellor Merkel of 18 May , where both heads of state indicate the need to ‘increase European capacities on research and development for vaccines and treatments’ and the need for open markets and trade, defining the pharmaceutical sector as a ‘strategic sector’.[12]

By working together, it is not only possible to beat the current pandemic, but with the right incentives and priorities, it is also possible to work together for a strong post-COVID-19 EU recovery and strategic resilience.

[1] ECSIP Consortium (2014) ‘Study on the relationship between the localization of production, R&D and innovation activities’, Report for European Commission, DG Enterprise and Industry, ENTR/90/PP/2011/FC, September 2014.

[2] Eurostat data, 2019.

[3] UN Comtrade, 2019.

[4] ECSIP Consortium (2014) ‘Study on the relationship between the localization of production, R&D and innovation activities’, Report for European Commission, DG Enterprise and Industry, ENTR/90/PP/2011/FC, September 2014.

[5] Erixon, F. and O. Guinea (2020), ‘Key Trade Data Points on the EU27 Pharmaceutical Supply Chain’, ECIPE, July 2020.

[6] Eurostat data, 2019.

[7] CAR-T stands for Chimeric Antigen Receptor (CAR) T-Cell therapy

[8] https://clinicaltrials.gov/ [accessed 23 June 2020]

[9] https://voxeu.org/article/smoot-hawley-america-first-and-strategic-sovereignty [accessed 3 July 2020]

[10] https://voxeu.org/article/new-ebook-covid-19-and-trade-policy-why-turning-inward-wont-work [accessed 20 June 2020]

[11] https://ec.europa.eu/commission/presscorner/detail/en/IP_20_1042 [accessed 25 June 2020]

[12] https://www.bundesregierung.de/resource/blob/973812/1753772/414a4b5a1ca91d4f7146eeb2b39ee72b/2020-05-18-deutsch-franzoesischer-erklaerung-eng-data.pdf?download=1 [accessed 29 May 2020]